Discover The Secret

IRS LOOPHOLES

Americans Are Using To Protect & Secure Their

Wealth With GOLD

Claim Your FREE Gold & Silver IRA Kit

Valid Number Essential –

Order with Confidence, Your Information is 100% Secure

Goldco Enjoys Excellent Reviews on the Top Independent 3rd Party Protection Websites

If you are like most Americans, a majority of your income and assets are based on U.S. dollars. That means your day-to-day quality of life depends on a currency that can lose value quickly, which is why more savers are turning to a gold hedge against inflation to defend their purchasing power as America struggles with inflation, market volatility, economic uncertainty, and, most importantly, its multi-trillion-dollar debt level.

That is where a precious metals IRA comes in. If you’re comparing precious metals IRA accounts, this page will show you how to hedge against inflation with physical gold and other precious metals, so you have a practical hedge against inflation and ongoing economic shocks. A thoughtful gold hedge against inflation can help protect your purchasing power and strengthen your retirement security when traditional paper assets come under pressure.

Did You Know…?

- Use the IRS rules that allow you to hold precious metals bullion inside a tax-advantaged precious metals IRA account, so part of your savings acts as a hedge against inflation instead of sitting fully exposed to dollar erosion.

- Follow the same approach that family offices and trusts use when hedging against inflation, currency devaluation, and taxes by owning carefully selected bullion that is separate from traditional Wall Street assets.

- Most important of all, choose a top-rated provider so your account is set up correctly, your metals meet IRS rules, and your gold hedge against inflation benefits remain intact for the long term.

A precious metals IRA account with Goldco just in time for 2026 could help you establish a compliant bullion-based IRA quickly and clearly as part of a broader strategy to hedge against inflation.

As a result, you gain peace of mind knowing your savings are structured to maximize tax advantages when it matters most and that a portion of your wealth stands as a tangible hedge against inflation, rather than relying entirely on paper promises.

Gold Hedge against Inflation and Economic Uncertainty in 2026

The past few years have been marked by heightened economic uncertainties and evolving financial challenges. The global pandemic revealed vulnerabilities in supply chains, workforce dynamics, and healthcare infrastructure. While much of the immediate crisis has passed, its ripple effects persist and keep many Americans searching for the best hedge against inflation going forward.

The past few years have been marked by heightened economic uncertainties and evolving financial challenges. The global pandemic revealed vulnerabilities in supply chains, workforce dynamics, and healthcare infrastructure. While much of the immediate crisis has passed, its ripple effects persist and keep many Americans searching for the best hedge against inflation going forward.

Today, concerns have shifted to soaring inflation, potential banking sector instability, and geopolitical tensions that strain international trade and markets. Governments worldwide are grappling with record-high debt levels, while central banks weigh precarious decisions between economic stimulation and inflation control. For retirement savers, these realities highlight the importance of diversification with assets that can act as reliable hedges against inflation and financial turmoil.

How to Hedge Against Inflation with Physical Gold

Gold has re-emerged as a cornerstone of financial security. With its time-tested ability to retain purchasing power, it offers a straightforward way of hedging against inflation and currency devaluation. Rather than relying solely on paper assets, more Americans are adding physical gold to their IRA or personal holdings so that part of their savings is anchored in a tangible gold hedge against inflation that has survived wars, recessions, and currency resets.

History shows that during periods of high inflation and stagflation, gold often holds its value or even outpaces rising prices. While no strategy can erase risk completely, positioning gold as a core part of your personal hedge against inflation can help you face the future with greater confidence, especially when headlines point toward higher prices, rising debt, and ongoing uncertainty.

Overall Best Gold IRA for a Gold Hedge Against Inflation: Goldco

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

If you’re looking to help preserve your wealth in today's uncertain financial landscape, Goldco offers significant experience and a full-service approach. Goldco's precious metal accounts let you create your own personal gold hedge against inflation and political instability. As a solid company with a record of strong customer satisfaction, Goldco is ideally positioned to help you create a secure retirement.

Did you know that precious metal IRAs may only include bullion bars and coins from an IRA approved selection? The metals must be COMEX/NYMEX accredited. That is a precious metals owner friendly regulation since the bullion must be sufficiently pure to meet these requirements.

With silver, the products must be 0.999 pure to be deemed suitable for precious metal IRAs. Bullion coins are valued on their precious metal content only. Collectible, numismatic, and slabbed/graded coins are not permitted in an IRA (with the exception of American proof gold and proof silver Eagles). The IRS also requires that your metals are held with an IRA-approved custodian.

Of course, when you open your precious metals IRA account with a top-rated precious metals IRA company such as Goldco, these details are taken care of for you, so your gold hedge against inflation remains compliant and clearly documented.

Claim Your Free Information Kit

Click to Download the Best Overall Choice Now

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

At Goldco, your precious metals-backed IRA holdings will be stored in an insured and licensed depository. And your account will be managed by an approved custodian.

This provides you with maximum peace of mind that your retirement account is backed by the rigorous requirements defined by the IRS, while your metals serve as a tangible hedge against inflation and currency shocks.

Goldco is an industry leader, built on unwavering ethics and a continuing commitment to a positive customer experience. Additionally, the company is recognized for its efforts to educate customers about the value of precious metals-backed IRAs in today’s inflationary environment.

Goldco’s professional approach makes them easy to deal with. After learning about your goals and answering all of your questions, Goldco specialists will walk you step-by-step through the entire process. This thorough approach helps ensure proper compliance, so you’ll lock in all the tax-saving benefits of this unique way to hedge against inflation with physical metals.

Goldco works with all the leading Self-Directed IRA custodians and will help you select the best one for your needs. They will also arrange secure vaulting with leading precious metals depositories. Throughout the process, Goldco is with you every step of the way.

Goldco Gold and Silver IRA Review of Fees and Costs

Goldco Gold and Silver IRA Review of Fees and Costs

Goldco offers both a precious metals Self-directed IRA option and a Non-IRA cash purchase. Here is our summary of their fees and costs.

(Please note that fee information is current as of this review.)

Minimum Purchase Requirements:

Custodian Fees:

The following fees are charged by the custodian that manages your account, not Goldco.

Setup Fees:

Annual Fees:

Storage/Insurance: $100 non-segregated storage. Add $50 for segregated storage

Early Bird Bonus: Get up to 10% in FREE* Silver

Here’s a special offer that could help you further protect your retirement in dangerous times. By acting fast, you can qualify for up to 10% in BONUS silver when you open and fund a precious metals-backed IRA.

Goldco is offering up to 10% in FREE Silver when you open your new precious metals-backed IRA account to help get you started on your precious metals journey. (As a limited-time offer, please contact Goldco for details on availability and how to qualify.)

Example:

- Open a Silver IRA with $100,000 and Goldco will award you $10,000 in FREE SILVER.

Send It Anywhere ✓

It’s your choice! Elect to have your FREE bonus Silver sent to your home with FREE SHIPPING or arrange to have it deposited directly into your new precious metals-backed IRA.

How To Claim: To take advantage of this offer, just mention the 10% FREE Silver Promotion to your Goldco Representative. They will explain the offer when they contact you to arrange shipping of your free precious metals IRA kit.

*Applies only to qualified orders. Get up to 5% back in FREE Silver when you purchase $50,000 – $99,999. Get up to 10% in FREE Silver when you purchase $100,000 or more. Cannot be combined with any other offer. Additional rules may apply. Contact your representative to find out if your order qualifies. For additional details, please see your customer agreement. Goldco does not offer financial or tax advice.

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

The Retirement Saver's Dilemma

Economic risks are no longer theoretical. They are now part of everyday reality for millions of Americans. Rising inflation continues to eat away at purchasing power, and potential stagflation scenarios threaten to interrupt even the most carefully planned savings strategies. Banking sector instability also appeared in 2024, with a few notable collapses reigniting fears of broader systemic risk.

Geopolitical tensions—from struggles over energy supplies to competition for technological dominance—are reshaping global markets. These disruptions create challenges for traditional approaches to protecting wealth. Supply chain fragility, paired with rising demand for essential goods, adds further volatility to the economic outlook.

Why a Gold Hedge Against Inflation Matters Now

Economist Robert Shiller has warned that the United States is entering “uncharted economic territory.” Central banks are using unconventional monetary strategies to stabilize markets, yet inflation continues to pressure the dollar. Many savers now find their accounts underperforming while inflation steadily erodes real value. Because of this, more people are turning toward a gold hedge against inflation to anchor part of their savings to something tangible and historically dependable.

A carefully structured hedge against inflation helps offset the uncertainty that now defines the global economy. Physical gold has a unique ability to hold purchasing power, even when paper assets struggle. That is why it remains a preferred tool for hedging against inflation among people seeking a defensive, stability-focused option.

“If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.”

Owning gold offers protection against inflation, market volatility, and systemic risks. Adding it to your IRA amplifies these benefits through meaningful tax advantages while serving as a powerful gold hedge against inflation.

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

Likelihood of an Extended, Deep Recession

As of late 2024, global government debt has surpassed $70 trillion, and major economies continue to experience uneven growth. Persistent inflation, combined with rising interest rates, places additional pressure on national budgets and household savings. Because of these trends, many Americans are looking for the best hedge against inflation so they can maintain purchasing power during economic slowdowns.

As of late 2024, global government debt has surpassed $70 trillion, and major economies continue to experience uneven growth. Persistent inflation, combined with rising interest rates, places additional pressure on national budgets and household savings. Because of these trends, many Americans are looking for the best hedge against inflation so they can maintain purchasing power during economic slowdowns.

Key Factors Fueling Recession Risks

Several major forces could deepen financial instability in the coming years. These risks continue to raise concerns for savers seeking a reliable gold hedge against inflation that can counter ongoing volatility.

- Rising interest rates: Higher borrowing costs strain households, companies, and governments. As more income goes toward servicing debt, long-term financial pressure increases.

- Geopolitical instability: Conflicts over energy, trade, and technology disrupt global supply chains and create unpredictable economic outcomes.

- Persistent inflation: Elevated prices erode consumer purchasing power, forcing families to stretch every dollar. A solid hedge against inflation becomes increasingly important during these periods.

- Corporate debt risk: Over-leveraged companies, especially those with weaker credit ratings, face a higher risk of default during tightening cycles.

These challenges highlight why hedging against inflation with physical gold remains appealing to so many people today. Gold often rises when uncertainty increases, and it has a long history of holding value when traditional assets decline. As a result, positioning gold as part of a broader strategy to hedge against inflation can help anchor your savings during chaotic market cycles.

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

Goldco Gold IRA Reviews

Here’s a closer look at what Goldco customers are saying. These real experiences explain why so many Americans choose Goldco when they want a reliable gold hedge against inflation and a trustworthy way to protect their savings during uncertain times.

![]()

“I have made three purchases of gold and silver from Goldco. They have always been very professional, organized and extremely helpful. I highly recommend you contact them if you are interested in learning more about how to purchase gold and silver coins.”

Tim M.

![]()

![]()

“Converted my 401K stock to a silver coin 401K in precious metals. The process was easy and painless and my broker along with all the other people I worked with was really GREAT! Thanks Goldco. I will recommend you to everyone I know.”

Kenneth R.

![]()

![]()

“Goldco has been wonderful to work with as our first experience in purchasing precious metals. Every step explained and great customer service in answering all our questions. We are very pleased to be new customers.”

Anita D.

![]()

These reviews illustrate why Goldco remains a top choice for Americans seeking to build a dependable hedge against inflation with physical precious metals.

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

Safe-Haven Assets

Global conflict, supply chain shocks, and high inflation have reshaped how Americans think about long-term security. These pressures highlight why more savers are seeking a dependable gold hedge against inflation that can help protect purchasing power when world events disrupt traditional markets. Although many assets can act as a refuge in difficult times, only a few have demonstrated consistent resilience across centuries.

Global conflict, supply chain shocks, and high inflation have reshaped how Americans think about long-term security. These pressures highlight why more savers are seeking a dependable gold hedge against inflation that can help protect purchasing power when world events disrupt traditional markets. Although many assets can act as a refuge in difficult times, only a few have demonstrated consistent resilience across centuries.

Which Safe-Haven Options Still Offer True Stability?

A safe-haven asset provides protection during times of financial stress. These assets typically show strength when the broader economy weakens. Although people may turn toward real estate, certain commodities, or even cash reserves, each option carries its own vulnerabilities. Rising interest rates can impact real estate, while currency weakness affects the actual value of cash.

Because of these limitations, many Americans continue choosing physical precious metals as part of their overall approach to hedging against inflation. Unlike paper-based assets, gold is not created, printed, or diluted. This makes it especially appealing during periods of high inflation, political instability, or extended recession risk.

Gold – The Oldest Safe-Haven

Gold has safeguarded purchasing power throughout ancient history, global crises, and modern recessions. Its value does not depend on corporate earnings reports or government policy decisions. Instead, gold draws its strength from widespread global demand and its limited supply. This combination has made it a reliable option for people seeking the best hedge against inflation when paper currencies lose ground.

Gold has safeguarded purchasing power throughout ancient history, global crises, and modern recessions. Its value does not depend on corporate earnings reports or government policy decisions. Instead, gold draws its strength from widespread global demand and its limited supply. This combination has made it a reliable option for people seeking the best hedge against inflation when paper currencies lose ground.

Why Gold Remains a Powerful Hedge Against Inflation

Gold stands apart because it maintains stability even when mainstream financial systems become strained. During periods of high inflation or currency weakness, the metal’s purchasing power often stays consistent. That resilience is the reason so many households turn toward gold as a hedge against inflation when headlines point toward price increases, geopolitical conflict, or debt-driven uncertainty.

Man's Attraction to Gold Metal

The yellow metal has captured human imagination since the earliest civilizations recorded their history. Ancient cultures valued gold not only for its beauty, but also for its durability and universal appeal. Even in ancient times, people recognized gold as one of the strongest hedges against inflation because it retained value through wars, migrations, and economic transitions.

- Varna culture

The Varna necropolis, dated to roughly 4600 BC, contains the oldest known gold treasure in the world. Archaeologists found gold jewelry, ceremonial pieces, and ornate artifacts, revealing that early societies viewed gold as a symbol of status and enduring worth.

As history progressed, gold remained central to many civilizations. Its universal recognition made it the closest thing to a global standard of value long before modern currencies existed. This helps explain why people continue hedging against inflation with physical gold today.

- Sumerians

Members of the world’s earliest known civilization crafted gold chains, ornaments, and ceremonial objects more than 6,000 years ago.

- Egyptians

Pharaohs valued gold so highly that the capstones of the pyramids in Giza were once adorned with it. The death mask of King Tutankhamun remains one of the most famous examples of ancient gold craftsmanship.

- Incas

For the Inca civilization, gold represented the “sweat of the Sun God.” Spanish explorers reported entire rooms and statues made of gold, fueling global myths about the legendary city of El Dorado.

Historically Documented

Gold is referenced repeatedly in ancient texts, including the Torah and numerous writings from Roman and Greek scholars. These cultures used gold for trade, adornment, and religious ceremony, recognizing its unique ability to preserve value across generations.

The global pursuit of gold has motivated explorers, fueled migrations, and shaped economies. From Brazil in 1693, to Australia in the 1850s, South Africa in 1886, the Klondike in 1896, and Kenya in 1932, people traveled vast distances in search of the metal they trusted most. This enduring appeal helps explain why gold remains central for anyone seeking a strong, dependable gold hedge against inflation today.

Gold and Mercantilism

For centuries, powerful nations viewed gold as a strategic resource essential for global influence. During the 16th to 18th centuries, European empires used mercantilist policies to stockpile precious metals.

For centuries, nations saw gold as a resource that strengthened their position in the world. Leaders believed their countries became more secure when they held greater amounts of gold and silver.

This mindset shaped trade routes, colonial expansion, and global politics for generations.

Under mercantilism, countries aimed to export more goods than they imported. The idea was simple: if gold and silver flowed into the nation, the economy appeared stronger. Because these metals held their purchasing power over long periods, they served as early hedges against inflation at a time when paper money was easily manipulated or devalued.

The Universal Measure

As world trade expanded, gold became the universal measure of economic power. Nations competed fiercely for territories rich in natural resources, since controlling mines meant controlling a reliable store of value. These efforts further reinforced gold’s reputation as a dependable safeguard during financial uncertainty.

Even though today’s monetary systems are more complex, history shows that gold consistently acts as a stabilizing force. Its unique qualities—scarcity, durability, and worldwide recognition—continue to make it relevant for people seeking a strong gold hedge against inflation amid rising prices and political volatility.

Gold and American Currency

Gold played a defining role in shaping America’s early monetary identity. From the nation’s founding through the early 20th century, U.S. currency was closely tied to gold because it provided stability that paper money alone could not deliver. As a result, people trusted gold as one of the most reliable hedges against inflation long before modern economic policies existed.

In 1792, Congress established a bimetallic standard linking the dollar to both gold and silver. This system aimed to keep currency values predictable, since precious metals could not be created at will. However, as the economy grew and industrial needs shifted, silver became less practical to use. This led the United States to adopt the classical gold standard in 1900.

The gold standard limited inflation because every paper dollar required a corresponding amount of physical gold held in reserve. Although the system placed constraints on government spending, it also strengthened confidence in the dollar. Many families appreciated that gold helped maintain purchasing power, especially during periods of uncertainty. This reputation continues today, as gold remains widely recognized for supporting a stable gold hedge against inflation.

The Great Depression

During the Great Depression, millions of Americans faced severe financial hardship as banks collapsed and unemployment soared. To stabilize the monetary system, President Franklin D. Roosevelt issued orders that changed how gold and currency interacted. In 1933, he prohibited banks from redeeming paper currency for gold and required citizens to return certain gold coins and certificates to the Treasury in exchange for paper money. Soon after, the government raised the official gold price to $35 per ounce, which remained in place for decades.

These actions reshaped the nation’s relationship with gold. Although controversial, Roosevelt’s policies aimed to protect the financial system from further collapse. Many families continued to view gold as a dependable store of value during this turbulent period. Even now, this history helps explain why so many people turn to a steady gold hedge against inflation when the economy shows signs of strain.

Post-World War II

After World War II, global markets grew more interconnected, and the United States maintained gold convertibility for foreign settlements under the Bretton Woods Agreement. However, persistent inflation, trade imbalances, and rising deficits increased pressure on the dollar. By 1971, President Richard Nixon ended gold convertibility entirely, creating the modern fiat currency system.

Once the gold link ended, the dollar’s value depended on economic policy, interest rates, and public confidence rather than a fixed amount of physical metal. Because fiat money can lose purchasing power quickly during inflationary periods, many Americans continue hedging against inflation with physical gold to maintain long-term stability.

In 1975, President Gerald Ford lifted the last remaining restrictions on private gold ownership. For the first time in more than 40 years, Americans could legally hold gold in any form. This renewed access strengthened gold’s role as a personal safeguard, especially for those who prefer tangible, globally recognized assets as part of their strategy for creating a strong gold hedge against inflation.

Is Gold a Good Hedge Against Inflation and Deficits?

In a nutshell, yes. For anyone watching their purchasing power shrink, a gold hedge against inflation becomes a practical way to counter rising prices and ongoing monetary expansion. When governments run large budget deficits, the pressure to create more currency grows stronger. Some economists attempt to justify this by calling it a “merger of fiscal and monetary policy,” yet their explanation sidesteps the simple truth that there is no free lunch.

As more currency enters circulation, its value declines. The cycle often continues because the same authority issues the debt and produces the currency used to support it. This dynamic also assumes future buyers of government debt will continue absorbing new issuance. Currently, U.S. citizens and institutions hold about 61% of federal debt, while foreign investors hold the remaining 39%. If refinancing that foreign-held portion becomes difficult, the consequences could be significant.

History's Hard Lesson

History repeatedly shows that expanding fiat currency without increasing real economic output leads to less purchasing power. Gold, however, retains its buying strength, which is why many savers view it as one of the most reliable hedges against inflation.

The amount of goods available does not change.

At first, consumers appear to gain purchasing power, but firms quickly raise prices in response.

As these adjustments continue, the cycle creates the conditions for rapid inflation and, in severe cases, full-blown hyperinflation.

Because gold is finite, its supply doesn’t expand with political decisions.

When additional currency reaches consumers, they experience a short-lived boost in buying power. However, businesses eventually raise prices to match their rising costs. As a result, households face higher prices while their money buys less.

Historical Cycle Consequences

These cycles can escalate into runaway inflation or severe episodes of hyperinflation, as seen in Hungary after WWII and Yugoslavia in the mid-1990s. For this reason, many people look for the best hedge against inflation before instability occurs, not during it. Over time, the repeating nature of these crises has made hedging against inflation a steady priority for those focused on long-term stability.

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

Acquiring and Holding Gold

People choose physical gold for many reasons, but one of the most consistent is protection from rising prices. When inflation erodes the buying power of the dollar, a strong gold hedge against inflation helps maintain long-term stability. Gold’s durability and global recognition make it appealing for those who want a tangible store of value during periods of economic uncertainty.

There are several ways to hold gold. Some prefer personal possession, while others choose secure storage facilities that specialize in safeguarding precious metals. Each method offers its own level of flexibility and convenience. For example, keeping coins at home provides immediate access, yet professional storage offers added security for larger holdings.

Gold Considerations

Before acquiring gold, many people consider purity, weight, and form. Popular options include government-minted coins, rounds from private mints, and bars suitable for long-term holding. Although these forms differ slightly in appearance and premium, they all offer the same core benefit: dependable hedging against inflation when currency values weaken.

Another factor to consider is liquidity. Gold is recognized worldwide, so converting it into currency is usually straightforward. This ease of exchange adds to gold’s reputation as one of the most practical hedges against inflation, especially in times when financial markets become unpredictable.

When inflation continues rising, households often look for assets that can hold value even as everyday prices climb. Because gold does not depend on corporate performance, political cycles, or digital systems, it remains a favored option for those seeking the best hedge against inflation during uncertain periods.

Gold Prices

Gold prices shift over time, but the metal’s long-term resilience remains one of its defining strengths. When inflation rises, the price of everyday goods increases, and many households begin searching for a reliable gold hedge against inflation. Because gold does not rely on quarterly earnings or political decisions, its value often moves independently from traditional financial markets.

Key Economic Pressures Explained

Short-term price swings occur for many reasons, including currency fluctuations, global events, and changes in demand. However, these movements do not change gold’s underlying role as one of the most consistent hedges against inflation. History shows that gold tends to outperform when purchasing power weakens, which is why so many people rely on it during periods of economic stress.

Gold also benefits from global recognition. Whether someone holds coins, rounds, or bars, the metal’s value is understood in nearly every country. This level of acceptance makes gold easy to exchange, especially when the dollar experiences rapid inflation or uncertainty. As a result, those focused on hedging against inflation often view gold’s global demand as a major advantage.

Another reason gold prices remain strong over long periods is the metal’s limited supply. Unlike currency, gold cannot be created with a policy decision. This scarcity helps preserve real value, even when deficits grow or inflation accelerates. Because of this, many savers consider gold the best hedge against inflation during years of rising prices.

While gold prices may rise or fall from month to month, the long-term pattern remains clear: gold has preserved purchasing power through depressions, recoveries, currency devaluations, and modern inflation cycles. This history helps answer a common question—Is gold a good hedge against inflation? The record strongly suggests yes, especially for those seeking steady protection during times of financial uncertainty.

Types of Gold Metal Holdings

People use several forms of physical gold to create a dependable gold hedge against inflation. Each type offers unique advantages in terms of purity, size, and ease of storage. Although the forms differ slightly, they all share the same purpose: helping maintain purchasing power when inflation rises.

The most common options include government-minted coins, privately produced rounds, and bars of various weights. These categories make it easier for individuals to choose the form that best fits their goals, whether they prefer smaller pieces for flexibility or larger bars for long-term holding.

Gold Coins

Government-issued coins, such as the American Gold Eagle and the Canadian Maple Leaf, remain extremely popular because they are widely recognized and easy to verify. Their popularity also helps with liquidity, which is valuable when hedging against inflation during volatile periods.

Gold Rounds

Gold rounds are produced by private mints and usually contain the same purity as government coins. They often carry lower premiums, making them appealing for those who want straightforward hedges against inflation without the added collectible value found in some coins.

Gold Bars

Gold bars come in many sizes, from small 1-gram pieces to large 1-kilogram bars. Their compact form makes them easy to store in safes or secure vault facilities. Because bars maximize the amount of gold per dollar spent, they are frequently chosen by people focused on creating the best hedge against inflation as prices rise.

Regardless of the form selected, gold’s physical nature remains its strongest quality. It does not depend on market algorithms, political cycles, or digital systems. This independence makes each of these forms a practical choice for anyone asking, “Is gold a hedge against inflation?” History continues to show that physical gold helps preserve value when currency weakens, which is why so many people turn toward gold holdings during inflationary cycles.

Precious Metals Self-Directed IRA

The IRS requires that any gold placed in a self-directed IRA meet specific purity standards and come from approved mints or refiners. This ensures that the bullion inside the account is genuine, properly regulated, and easy to verify. As a result, people who are focused on hedging against inflation often appreciate the added structure these rules provide.

Approved Custodian Required

All metals held inside a self-directed IRA must be stored with an approved custodian. This requirement protects the integrity of the account and keeps the metals secure. Although the rules may appear strict, they help maintain the account’s tax advantages while ensuring proper handling of the physical metal.

A well-structured precious metals IRA can also make it simpler to adapt to inflation cycles. When currency loses buying power and prices rise, physical metals tend to hold value more consistently than paper-based savings. This is why so many savers searching for the best hedge against inflation explore precious metals IRAs as a long-term safeguard.

For those comparing providers, Goldco remains a popular choice due to its streamlined process and strong support. They assist with custodian setup, documentation, and secure storage, making the process easier to complete. Their team also answers questions directly so you feel confident throughout the setup.

Click to Download the Best Overall Choice Now

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

With Goldco, your precious metals IRA holdings are stored in an insured and licensed depository. Their guidance helps ensure your account remains compliant, your metals remain protected, and your long-term strategy for hedging against inflation stays on track.

Final Thoughts

Periods of high inflation can create stress for households, especially when everyday prices rise faster than wages. In these moments, many people look for dependable ways to maintain purchasing power. History repeatedly shows that gold remains one of the strongest options for creating a lasting gold hedge against inflation.

Gold’s stability comes from qualities that do not change—its scarcity, durability, and worldwide recognition. Unlike paper currency, it cannot be created through policy decisions, and it does not depend on digital systems or corporate performance. Because of this independence, gold continues to serve as one of the most reliable hedges against inflation during unpredictable economic cycles.

Whether someone faces rising prices, currency weakness, or concerns about long-term financial stability, the question often becomes simple: Is gold a hedge against inflation? Based on centuries of real-world results, the answer remains consistently yes. Gold has preserved value through global crises, recessions, and inflationary surges, making it a trusted choice for those seeking stability.

If you want to learn more about how physical gold can help safeguard purchasing power during inflationary periods, the Goldco team can walk you through the details step by step. Their specialists answer questions directly and provide clear guidance, making the process straightforward.

Liberty, Justice and FREEDOM For All

It's up to us individually to be prepared for any challenges made to our hard-won way of life

Now You Can Be Prepared to Meet Those Challenges in a Tax-Advantaged Way with Gold…

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure

Gold has always been used as a means to preserve wealth.

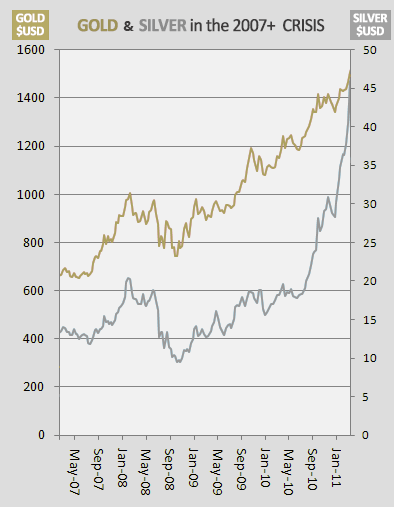

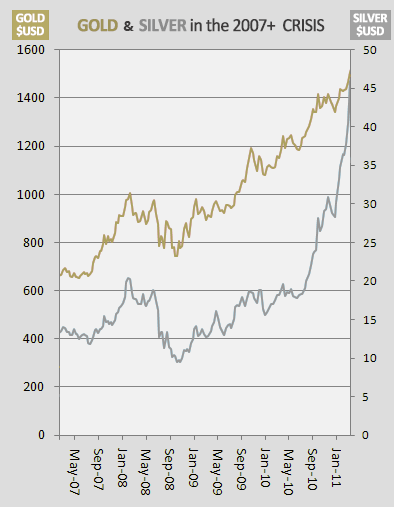

In the Financial Crisis of 2007 – 2008 millions of Americans were horrified to see their IRAs and 401ks lose over HALF their value.

But those who had planned ahead with Gold saw 200-400% increases.

… as quoted above, “If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation” and it's likely going to get worse before it gets better

Indeed, exactly how you use gold as a hedge against inflation and overall economic uncertainty to help protect your legacy and assets depends on your circumstances.

Your approach also reflects the specific risks you could face should our way of life come under pressure.

Most retirement savers opt for at least TWO of the following for maximum protection:

1) Gold in Your Home

2) Gold in a Secure Vault

3) Gold in Your IRA

Simply fill the short form on the next page by clicking below to claim your

FREE 2026 Goldco Gold and Silver IRA Kit

Click to Download the Best Overall Choice Now

Valid Number Essential – Goldco will Call to Confirm and Answer Your Questions

Order with Confidence, Your Information is Secure